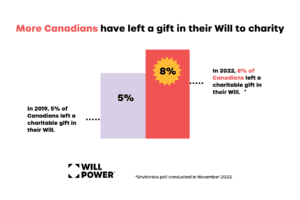

Did you know that, as part of your Will, you can set aside money for charity? And you’ll probably hear a lot more about it in the coming years: a Will Power study found a significant increase (5% to 8%) in the number of Canadians donating to charity in their Wills.

In real numbers, that’s 1.2 million more Canadians giving in their Wills, creating roughly $37 billion in future donations.

Think about what a big dent we could make for the people we support.

Why the surge in Will-based charitable donations?

One obvious reason is an economy forcing us all to hold our wallets a little (or a lot) tighter. Donating in your Will lets you make a big difference without using the money you need now. Even 1% in your Will could make an impact.

Try the Will Power legacy calculator to see what 1% of your Will could do

This, coupled with an urgency to do something in the face of growing global need, has made gifts in Wills a popular solution. Inflation and cost of living may have put pressure on Canadian incomes. But the desire to help has never been stronger. Here’s a way for people to drive the kind of change they want, and it’s well within their reach.

Another reason is demographics. Roughly a trillion dollars will be passed down over the next 10 years, the biggest wealth transfer in history. It’s given many of us pause, realizing we probably will have enough to support family AND a charity in our Wills.

Lastly, Canadians are just getting more savvy with their money. This includes harnessing the power of Wills, RRSPs and other assets to give more strategically. More on that later…

Why donate to charity in your Will?

It might sound funny to think of your Will as a tool for change in this world, but when it comes down to it, there are many benefits to donating this way:

Contribute more than you could otherwise.

You’ll be amazed just how far your donations stretch, and how much more you can do for DeafBlind Ontario Foundation with every extra dollar.

Remember, that the value of your “estate” is the sum of any property and/or business you own, your pension and/or registered funds, any securities like stocks or mutual funds, any cash savings, and life insurance. It adds up, even if you subtract debt.

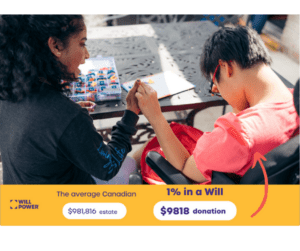

In fact, the average Canadian family in 2023 had a net worth of $981,816. If you put just 1% of that aside for charity, you’d be looking at a donation of about $10,000! When else could the average Canadian make such an extraordinary impact?

Continue the good work you’ve done.

Leaving a gift in your Will to DeafBlind Ontario Foundation is an expression of your values; something that provides purpose, pride or enjoyment See your contributions of time and money as an investment in DeafBlind Ontario Foundation, and your good work continuing beyond your lifetime.

Keep your memory alive in a unique way.

Imagine the pride your children or grandchildren will feel knowing that you’ve helped build a fully accessible supported living home to accommodate the needs of people who are deafblind, as well as those living with a developmental disability who are Deaf, hard of hearing or use non-traditional forms of communication. ? Or the honour it would be for them to be involved with securing a wheelchair accessible van, critical for providing access to medical appointments, grocery shopping, and social pursuits like getting together with a friend for coffee?

When your loved ones have something tangible, meaningful and bigger than you to associate with your memory, you will have created a legacy that future generations can rally around.

Tax breaks. Big ones.

Taxes probably aren’t the first thing you think about when it comes to charity. But Canada actually has some of the most generous charitable tax incentives in the world! In Canada, when you make a donation, you get a charitable tax credit that can go a long way to help pay down what you owe.

Your loved ones might need that charitable tax credit when you pass, because your estate is likely to be hit with a huge tax bill they’ll have to take care of. You can even structure your donation in different ways so that you get the biggest tax break possible.

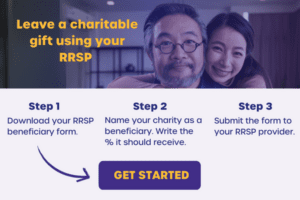

A popular approach is to name a charity as a beneficiary of your RRSP, because the credit received will close to cancel out what would be owed on this heavily taxed asset.

If you’re interested to learn more, you can always book a consultation with a financial advisor who specializes in charitable giving.

Read Jocelyn’s story about the power of giving!

How to write a Will that includes a charity.

It’s easier than you think. In fact, it can actually be fun to dream about the future and give shape to the mark you will make…

- It’s wise to book a chat with someone at DeafBlind Ontario Foundation to talk about your options and make sure they can fulfill your future wishes. If you’re thinking about making a donation in your Will to DeafBlind Ontario Foundation, thank you. You can speak to a member of the Foundation team at [email protected]

- Make sure you have our correct legal name and registration number. For reference our legal name is DeafBlind Ontraio Foundation and our registration number is 7969 14679 RR0001.

- Get a rough estimate of the size of your estate and what percentage you’d like to go to family vs. charity. P.S. The Will Power legacy calculator makes this really easy.

- Choose a lawyer, notary (if you live in Quebec or BC), or trusted online Will platform to draft your legal documents. You can find legal professionals who can help on the Will Power website too.

- Make sure your Will’s executor and your family know about your plans.

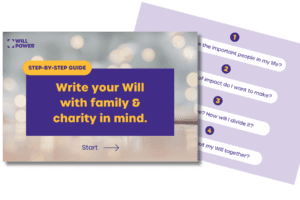

Download the Step-By-Step guide to writing a Will with family & charity in mind.

FAQs about donating to charity in your Will.

When donors find out about the option to leave part of their will to us, they almost all have follow-up questions. These (or variants on these) come up a lot.

What about my family? I want to leave everything to them.

It’s possible to support both family and charity in your Will. Think about your Will in terms of percentages. If you set aside even 1% in your Will for charity you can make a big difference (and help pay down taxes). And you’re still leaving 99% to support loved ones. It’s a win-win.

I don’t have much to give.

You might have more than you think. For example, donors are often surprised to hear that the RRSP or life insurance policy they have through work can be a smart way to give. It’s worth taking stock of your assets. Even a modest amount can make a big impact.

Do I have to be wealthy to leave a gift in my will?

No, it’s actually middle-income Canadians who typically give this way. Did you know that the average donation made in a Will, from the average Canadian, is thought to be around $35,000? That’s the power of gifts in Wills!

How will I know what my gift accomplishes?

You may not be able to see your gift in action. But when you leave a donation to DeafBlind Ontario Foundation in your Will, you become part of the family. We share our future goals with you, and how your gift fits into the plan which gets you closer to our mission to inspire investment in the future of individuals who are Deaf, hard of hearing, non-verbal and deafblind.

What if I change my mind?

Remember, your Will is not set in stone. People generally update their Will at least a couple of times in your life. You can always make changes. You might also consider tools outside your Will to make a legacy gift. For instance, you can name our charity as a beneficiary of your RRSP or life insurance policy, and make changes any time. No hassle, no fuss.

Am I too young to be thinking about this?

If you have any assets, you’re not too young to be thinking about what happens to them. Because if you don’t have a plan, the government (and CRA) do.

Is this all a bit morbid?

This is not about death. It’s about life; and your life specifically. It’s about the person you are, the values you demonstrate, and the example you want to set. Not enough people think about their legacy and take an active role in shaping it. It can be a very empowering process!

If you have any questions, please reach out to [email protected]

The Will Power campaign

DeafBlind Ontario Foundation is a partner in Will Power, a national awareness campaign that encourages Canadians to use their Wills as a force for good. Together with Will Power, we want connect people like you with resources to make the best decisions for their family, their future finances, and the causes that matter to them.

Recent Comments